How works Forex Fundamental Analysis

The concept of “fundamental analysis” first appeared in the American financial school on the lectures of Benjamin Graham and David Dodd, or rather, in their classic work “Security Analysis”.

At the time, the authors were among the ten most successful investors, and the famous Warren Buffett, who works on the market solely on the basis of fundamental assessments, is considered their modern follower.

So…

How does it work?

The result of any analytics should work on the forecast of price movements, that is, reflect the effect of the basic market principles. “The price history repeats” is implemented by technical analysis, and “the price includes everything” – by the fundamental (for the curious: see Fundamental research, Fundamental analysis).

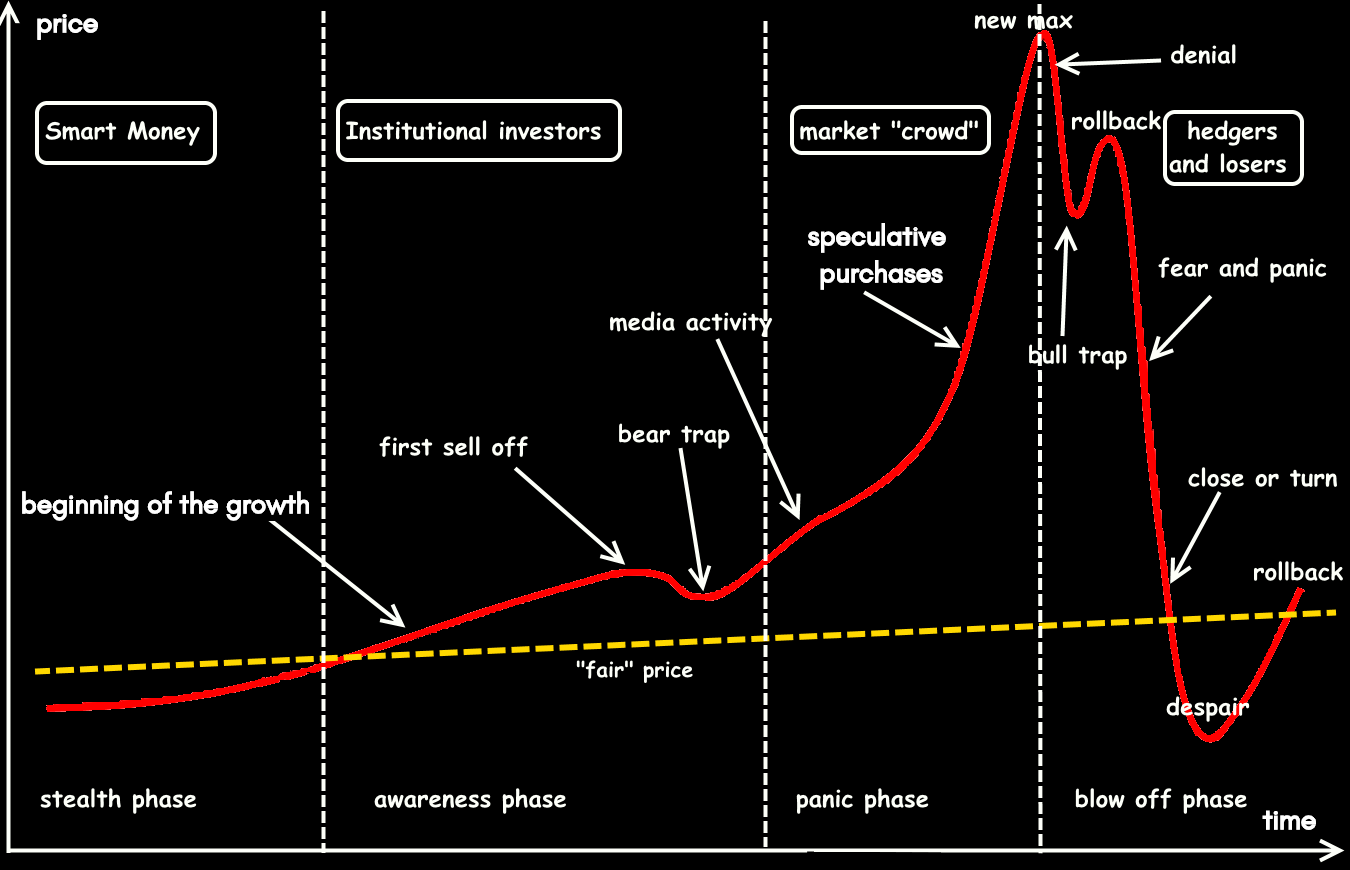

- If the current price of an asset is lower than the “fair” price, then the asset is considered oversold (too cheap), meaning the market should turn up – open buy deals.

- If the current price is higher than the “fair” – the asset is too expensive (overbought), and the price should decrease – consider transactions for sale.

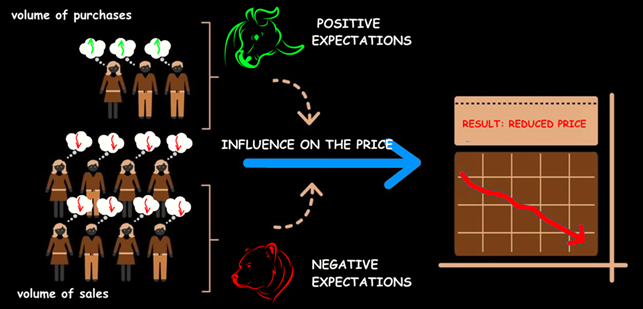

Large players with their speculative volumes constantly create a market imbalance to force a mass of small players (“market plankton”) to move in a particular direction. (see Using Graphic Tools).

Moreover, no single information can be considered a signal for a trade transaction – only complex estimates are needed.

Let’s take a closer look.

Purposes and methods

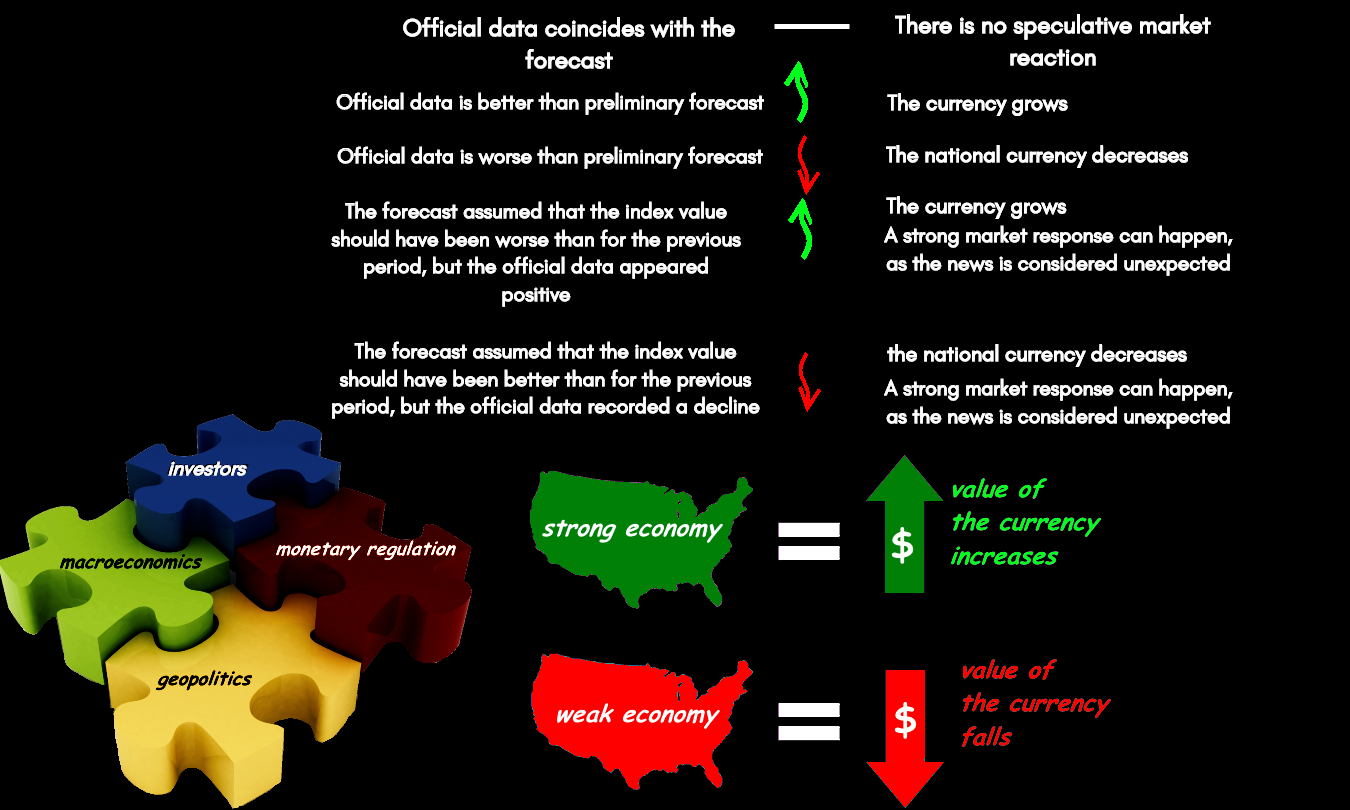

Not every information exerts “pressure” strong enough for the market. The standardly predicted factors are already taken into account by the price and cannot cause speculative fluctuations or reverse the trend.

The fundamental analysis begins by identifying the factors that mostly affect the selected trading assets. Each of the sections below will be given further consideration in separate articles, but for now, we will stop on the general theses.

Basic methods of fundamental analysis:

- Comparison method: an example is the compound effect of statistics from leading EU countries on the euro exchange rate.

- Method of induction and deduction: an example is comprehensive statistics (Beige Book), statistical reports of companies, the impact of the stock market on the dynamics of commodity currencies.

- Correlation method: an example is the dependence of AUD/USD on the price of gold or USD/CAD on the price of oil.

- Grouping and generalization method: an example is a generalized index of currencies of developing countries that affects the overall trend.

- Seasonality method: an example is the weather conditions affecting agriculture, the growth of purchases on holidays, the purchase of foreign currency for payments during the financial reporting period.

Fundamental analysis should assess:

- the long-term impact for the global or national economy for a period of 3-6 months to several years;

- the short-term impact on the market within a few hours (minutes).

Fundamental analysis should move from global data to smaller ones – regions, countries, industries, companies (assets, stocks) – from complex elements to simpler ones.

Everyone chooses the suitable fundamental analysis scheme for them, but according to the classics, the analytics should run like this:

- analysis of world markets, the presence of force majeure and crisis phenomena, the political and economic situation in leading countries;

- assessment of indicators and overall stability of the region (country, industry) whose asset is being analyzed;

- the impact of global and national indicators on the medium- and short-term dynamics of an asset.

«Rumors» and force majeure

The financial market is affected by all unforeseen phenomena of nature and society, and our task is to choose reasonable tactics of trading behavior.

A “rumor” is considered to be unverified information (including the listed above), as well as the hype before the release of statistics or any other event that causes a speculative price reaction.

Sometimes some kinds of information are thrown to the market on purpose. It’s been repeated, commented on, analyzed, forecasted so that major players “skim the cream” from the upcoming panic (we recommend a brilliant book by Peter L. Bernstein «Capital Ideas Evolving»).

However, the classic thesis “buy by the rumor, sell by the news” in the modern market does not work well. The real information is quickly taken into account in the price (dissolving in the market), and speculators can earn only on provocations.

Just small players lose money on “rumors”; the experienced speculators always hedge their risks with other assets to compensate for the possible losses when a “fact” appears.

Traditional force majeure events:

- Military conflicts: the aggressor country usually wins economically.

- Natural and human-made disasters: adversely affect the exchange rate of the national currency, prices for raw materials, and energy in the affected country or region.

- Any political instability (elections, crises, coups).

We remind you: in situations of force majeure, it is important to be sure that the broker executes the orders technically correctly (without slippage, loss of quotes, weak liquidity), and it is possible to close the deal quickly.

The sources of fundamental information

The main (but by no means all!) sources of information for fundamental analysis:

- official statistics and data;

- information of state and financial bodies (official and any public), as well as national banks, industry organizations;

- publications of information and analytical agencies, major economic publications;

- statements and comments of officials, heads of financial organizations, analysts, politicians, and business figures;

- reports and forecasts for the development of individual sectors of the economy, press releases;

- expert reviews, financial and corporate reporting, analytics of leading companies.

You must be sure of the source, filter the information, and treat any conclusions with healthy skepticism.

It is necessary to consider how official (and not quite) statistics are controlled and “moderated” by the state, monetary and corporate structures – its reliability depends on this.

It is a well-known fact that all official statistics and any other economic information of China is tightly regulated. Most often, it does not correspond to the real state of the economy and is formed depending on current political goals.

What is the result? Traders who constantly work with Asian assets prefer to receive information from independent agencies, for example, HSBC, Boom, GuocoGroup, Hong Kong Academy of Finance.

The optimal form for presenting the necessary information is considered an economic calendar, which is available on most sites and can also be integrated as an informer on any resource.

A few practical notes

Technical analysis studies the market’s “past,” but the future is determined by the economy, not statistics (see Using Indicators).

Fundamental information is always relative. Its analysis makes practical sense only if the country (region, company) of the selected asset operates in a market economy, meaning that there is no strict regulation, control and manipulation of data.

The same indicators, facts, events in different conditions exert different “pressure” on the market, and this ambiguity complicates the fundamental analysis.

Understanding of intermarket relationships and the ability to evaluate many factors comes only with the experience. Still, even having a successful technical trading strategy, one cannot ignore the influence of the foundation on the market. Otherwise, the market, to its advantage, will ignore you.

Try It Yourself

As you can see, backtesting is quite simple activity in case if you have the right backtesting tools.

To check this (or any other) analysis performance you can download Forex Tester for free.

In addition, you will receive 23 years of free historical data (easily downloadable straight from the software).

Sign Up to FTO Waitlist

Sign Up to FTO Waitlist