TDI indicator: hybrid, independent and effective. Take it to your team!

Hybrid indicator Traders Dynamic Index, the algorithm of which was created by the usual trader Dan Malone, performs a full-fledged market analysis: in addition to the direction and strength of the trend, it allows you to effectively assess volatility.

Despite the fact that the author’s strategy of Trading Made Simple was scalping (on M5-M15), practice proves that the indicator’s signals are effective on any timeframe and trading asset.

So let’s begin.

Logic and purpose

The purpose of this indicator is quite difficult to implement: you need to successfully catch a strong volatility, remove speculative throws, but still stay in the current trend.

So, the first task of the TDI indicator is to qualitatively filter the sections of the flat, the second − to distinguish between the price movement entry points, suitable for short-term and medium-term transactions.

That’s why the base for the indicator signals was the classic tools of RSI (for estimating the strength of the trend), Bollinger Bands (for estimating the amplitude of the oscillations) and Moving Average (removes speculative throws). A comprehensive analysis of the situation highlights the entry points with a high probability of success. There are no special secrets in the calculation mechanism, this indicator is a successful software solution that combines several indicators in one circuit and simplifies visual perception.

Calculation procedure

The indicator is based on a method of the calculation of RSI − all lines of the indicator are calculated on the information of the main oscillator. It forms the overall graphic picture, because the main task is to assess the rate of the change in the price.

Default settings:

- Price type for calculation − Close price (as the most reliable);

- the optimal period (in bars) is 13 (the recommended value is between 8 and 25);

- Smoothing method − simple average.

The next step: the range of volatility is determined by the Bollinger Bands indicator, the initial data for which is the current RSI values: this allows you to «diagnose» trend areas and flat periods. The parameters are normal, it is not recommended to change them. The middle line is highlighted in a separate color and is considered to be the base (balance) trend line.

The choice of parameters obeys the usual logic:

less parameter − higher sensitivity − more false signals − used for scalping on small timeframes; increasing the parameters makes the lines more stable, and trade signals − more reliable.

Parameters and control

The indicator TDI is included to a standard set of the popular trade platforms, but its different options can be downloaded freely on internet.

Traditionally for the oscillator, the indicator is located in an additional window under a price chart with the balance sheet level of 50 and additional levels above/below (author’s values − 32 and 68 are by default selected). Versions of the indicator with an audio signal at the appearance of the critical points are the most popular.

The green line is a flattened RSI with a small period (base); red is also RSI, but with a longer period (signal): the RSI indicator itself in the traditional form is not used.

Experiments with a price type for calculation do not lead to improvement of the quality of signals. Also it is not recommended to change the parameter StdDev (default = 1.6185) − the coefficient for the root-mean-square deviation for BollingerBands.

At first glance, it is rather difficult to understand this scheme of lines.

But let’s look at it in detail:

Trade signals of the indicator

At once we warn: to use critical points of the indicator as signals for an input − is risky enough. Its lines are used only for analysis, but the trading solution must be taken with the help of additional tools (see Graphic tools).

The result of the using of the indicator is an estimate:

Trend Directions

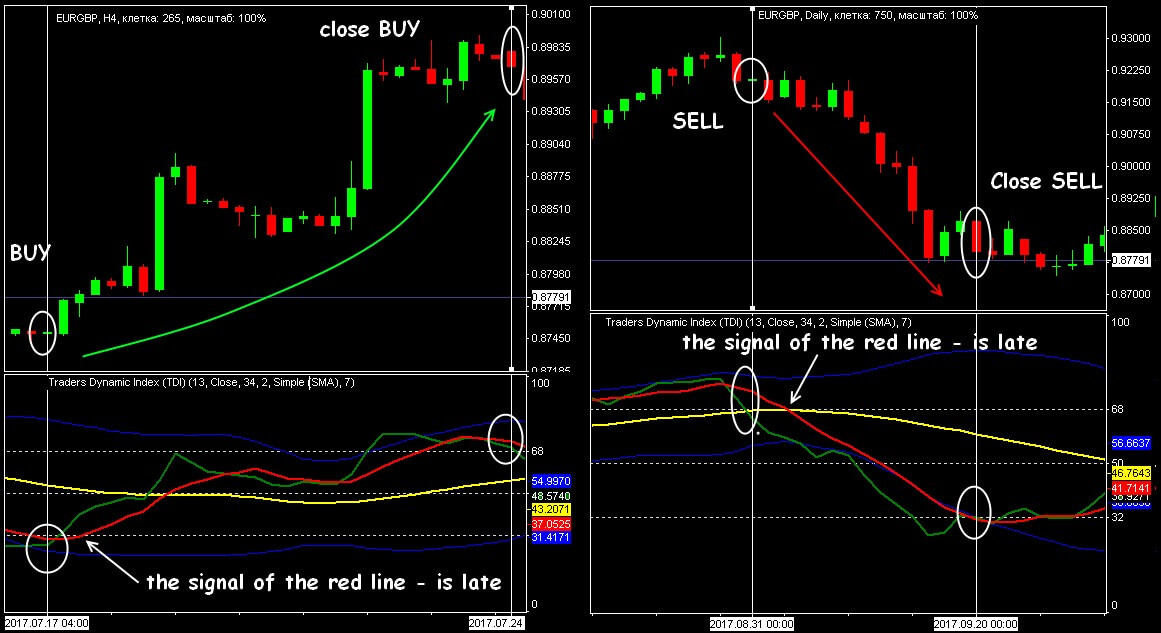

The short-term trend is determined by the relative arrangement of the green line with respect to the red line:

- the trend is considered ascending, while the green line moves above the red line;

- if the green line is below the red line, the market goes down.

The yellow line indicates a long-term trend and most of the trading time moves in the range between the levels of 32-68 − with the exception of speculative moments. This line will define key turns for change of a trend.

The global trend is defined similarly: by the arrangement of the yellow and red lines. While the main trend line is pointing down and the red line is below the yellow one − the trend is confidently bearish; for a growing market you need a mirror image − the yellow line looks up and the red line moves above it.

If the yellow line moves below the level of 32, then the market has reached a local minimum, so a breakdown from bottom to top with a high probability means a turn toward the «bulls».

The main line above level 68 − on the market a local top is formed, breakdown of the level from top to bottom suggests preparing for a turn towards «bears».

Trend force and the range of volatility

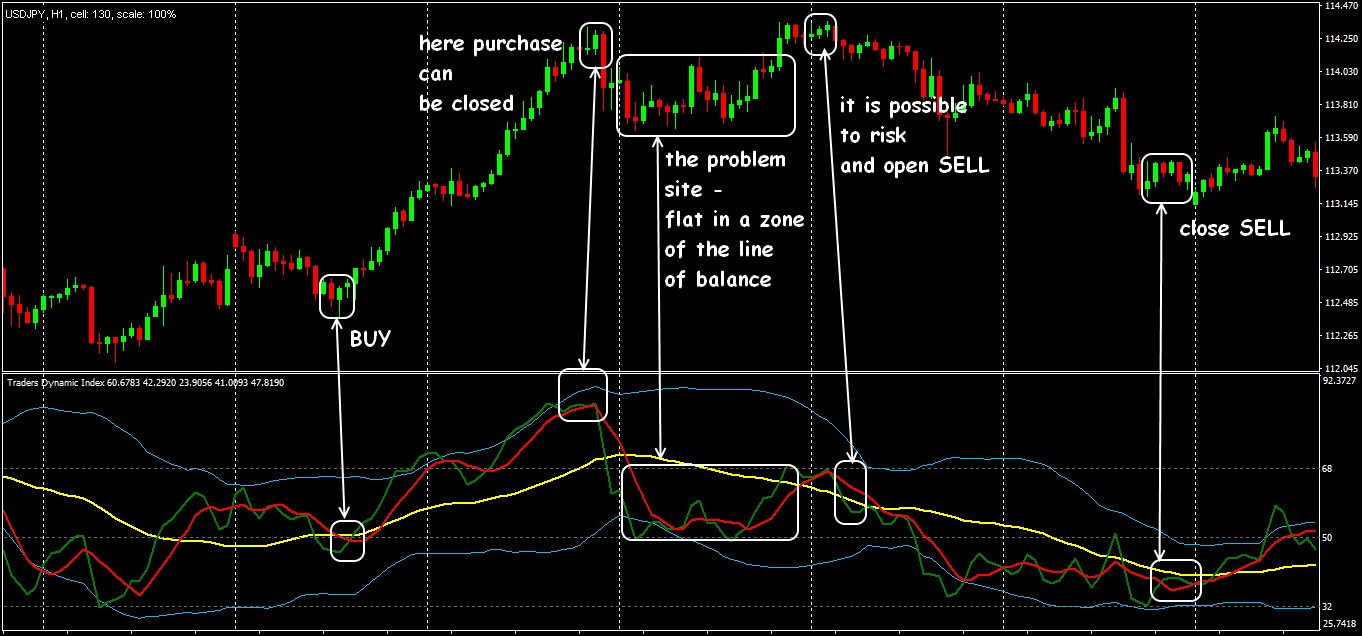

We perform the analysis of the relative location of the blue channel BollingerBands and RSI lines:

- If the channel borders diverge and the green line forms a strong direction (up or down), then there is active volatility on the market (the probability of strong directional movements or continuation of the current trend is very high);

- The greater the angle of the green line, the stronger the players in this direction;

- If the channel lines converge, and the RSI line shows short («nervous») movements − the market is already in the flat, or is preparing for this state;

- The closer the green line to the balance area (level 50), the less the market is active.

We remind you that the narrow BollingerBands channel and weak dynamics of RSI lines are always formed before strong speculation (news, opening/closing of trading sessions, etc.). In such periods, TDI signals cannot be trusted.

Traders Dynamic Index: direction and volatility

Critical overbought/oversold zones

The key element is considered to be the behavior of the green line:

- crossing level 68 from the top down (turn in the overbought zone) − a signal for sale;

- crossing level 32 from the bottom up (a turn in the oversold zone) is a signal to buy.

Signals for the breakdown of the key areas of TDI

Similarly, the situation of the crossing critical levels with a red or yellow indicator line can be interpreted, but such signals are very late and require mandatory confirmation.

Application in trade strategy

Unfortunately, the author of the famous Trading Made Simple is no longer with us, but the ideas of his trading system continue to develop (here almost 4000 pages of the forum on this topic!).

it’s signals may well replace the signals of a full trading system. The green line is the first to react to the turn and speculation, therefore its behavior is considered to be the key for the formation of the signal. The tactics of trading depend on the duration of the transactions (see here).

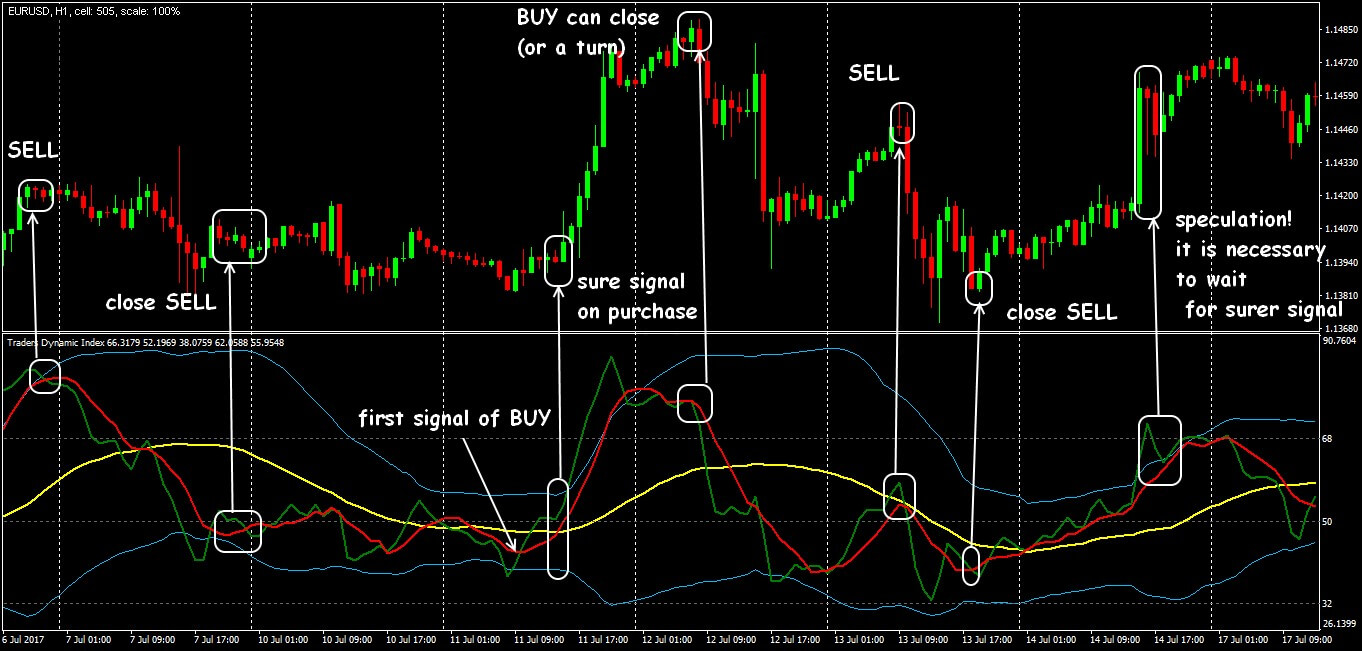

Scalper signals:

- For purchase: the green line crosses the red line from the bottom up; the intersection point must be above the balance line 50. The yellow line should support an uptrend.

- For sale: the green line crosses the red from top to bottom; the point of intersection is below level 50; the yellow line supports a downtrend.

Scheme of signals of the TDI indicator

A more conservative strategy (example here) suggests that in order to conclude a deal it is necessary that both lines (and the intersection point, of course) be above the yellow line − for purchase, or lower − for sale.

We open medium-term transactions after the analysis of the mutual arrangement of the red and yellow lines:

- if the yellow line is pointing down, and the red line is moving below it, then the market is a sure downtrend;

- if the yellow line is looking up, and the red line is above it, there is a strong upward trend in the market.

The fulfillment of the condition for the point of intersection (above/below level 50) is mandatory. In any case, to enter the Traders Dynamic Index signals the market should be quite active: BollingerBands lines must diverge, and the stronger, the more reliable the trading signal. Regardless of the availability of «suitable» intersection points, we miss periods of an explicit flat (see here).

Several practical remarks

Despite the external complexity of the lines, the indicator signals assume a classical interpretation and do not cause problems even for novice traders.

The TDI indicator is recommended to use on assets with stable volatility − major currency pairs and base crosses. Working period: is not less than H1-H4, confidence in signals on timeframes less than H1 is low.

The Traders Dynamic Index indicator is quite effective as an independent tool for trend analysis, and is also used in conjunction with other indicators (see Using Indicators) and filters to create more reliable trading systems.

Try It Yourself

After all the sides of the indicator were revealed, it is right the time for you to try either it will become your tool #1 for trading.

In order to try the indicator performance alone or in the combination with other ones, you can use Forex Tester with the historical data that comes along with the program.

Simply download Forex Tester for free. In addition, you will receive 23 years of free historical data (easily downloadable straight from the software).

Share your personal experience of the effective use of the indicator Traders Dynamic Index. Was this article useful for you? It is important for us to know your opinion.

Sign Up to FTO Waitlist

Sign Up to FTO Waitlist