Gap: learning how to make money on the market breaks

A gap is usually called the split in the graph of a market asset price between the closing price of the previous bar (candle, period) and the opening price of the next.

For fundamental analysis, such a situation means a sharp change in the interest of market participants in the current price zone and a shift in volumes above/below a certain range.

Trading on gaps is difficult, but sometimes very profitable. In any case, you need to understand what is happening on the market at that time, so let’s get started.

The fundamental conditions of pattern

The concept of a gap came from the stock market because there originally were technical conditions for its appearance. The exchange worked only a few hours a day, after which, at the end of the day, “unsatisfied” trading interest accumulated, and the usual period for technical analysis was D1.

A virtual off-market microtrend has been formed and developing quite quickly; the market stops panicking and then works out by the “technique”. It is the basic idea of working out (“closing”) the gap – the inverse correction to the opening price (see below).

Any fundamental force majeure, including non-market one, can be the cause of a gap in Forex: political, financial events, climatic or technological disasters can occur between the closing of the exchange and its opening.

At the close, the market accumulates a certain volume of buy/sell orders, in response to which counter orders do not have time to form. At the opening of the period, the price of the asset should close the orders accumulated during the period of the exchange inactivity.

As a result, for the demand/offer balance at the opening, participants have to enter the market at actual prices, which can differ significantly from the current market interest.

The interpretation of a gap as a period without transactions can be applied relatively correctly only to gaps at the opening of a trading week on Forex or a trading day on stock exchanges. During continuous trading, the causes of the price gaps are much more complex.

Technical parameters of the pattern

How is the price gap formed?

- the Bid price of the current tick is higher than the Ask price of the previous one – a gap up;

- the Ask price of the current quote is less than the previous bid price – a gap down.

For the usual period:

- the price of Bid min (Low) of the current period is higher than the Ask max (High) price of the previous period – a gap up;

- the price of Ask max (High) of the current period is less than the Bid min (Low) price of the previous period – a gap down.

A gap is considered partial if the opening price of the current day is higher than the closing price of the previous one, but not higher than the High price of the previous day.

Even in the formation of a partial gap, large capital is actively involved: insufficiently high demand may force the market maker to move the price above/below the day’s closing level to the levels of pending orders or stops. In situations with a full gap, the profit of working out can be several times higher than the daily level.

A gap inside the day occurs after the release of influential news or extraordinary events and can cause a different reaction from slight activity to disaster – recall flash crash in the Swiss franc on January 15, 2015.

In the medium term, the start and end price levels of the gap can be used as strong support/resistance zones (see Using Graphic Tools), but the problem is that in these zones, the severe volume of limit orders accumulate, due to which the trend may unfold. By the way, at the breakthrough of strong levels, gaps appear quite often.

Let’s take a closer look.

Types of Forex price gaps

Most often, the simplest gap is found on Forex – the quotation split between the closing of Friday and the opening of the market on Sunday (Monday); over the weekend, the events that we mentioned above happen. Identification of other situations requires practical experience.

- A common gap

A common gap appears in relatively calm markets or in the middle of trading ranges. Fundamentally, it means that there is little interest in the asset on the market, and even small investments in it cause sharp price surges. Most analysts ignore such a signal.

- A breakaway gap

It occurs at the end of a strong graphical model or in the area of consolidation when the price has not been able to overcome the support/resistance level for a long time.

Such situations indicate the beginning of strong volatility, which can be considered a signal of the beginning of a strong trend, and are accompanied by an increase in the volume.

The breakout point becomes a new power level (support/resistance); such a gap often remains unfilled, as the market changes direction for a long time.

A runaway or measuring gap

It arises in the direction of the current trend after its stabilization as a result of a growing interest in buying/selling an asset.

It is used by analysts to assess the trend strength: the distance from the start of a reversal to the gab occurrence is considered half the total length of the trend (see Using indicators).

You can add positions in the main direction: buy on a bullish gap and sell on a bearish one.

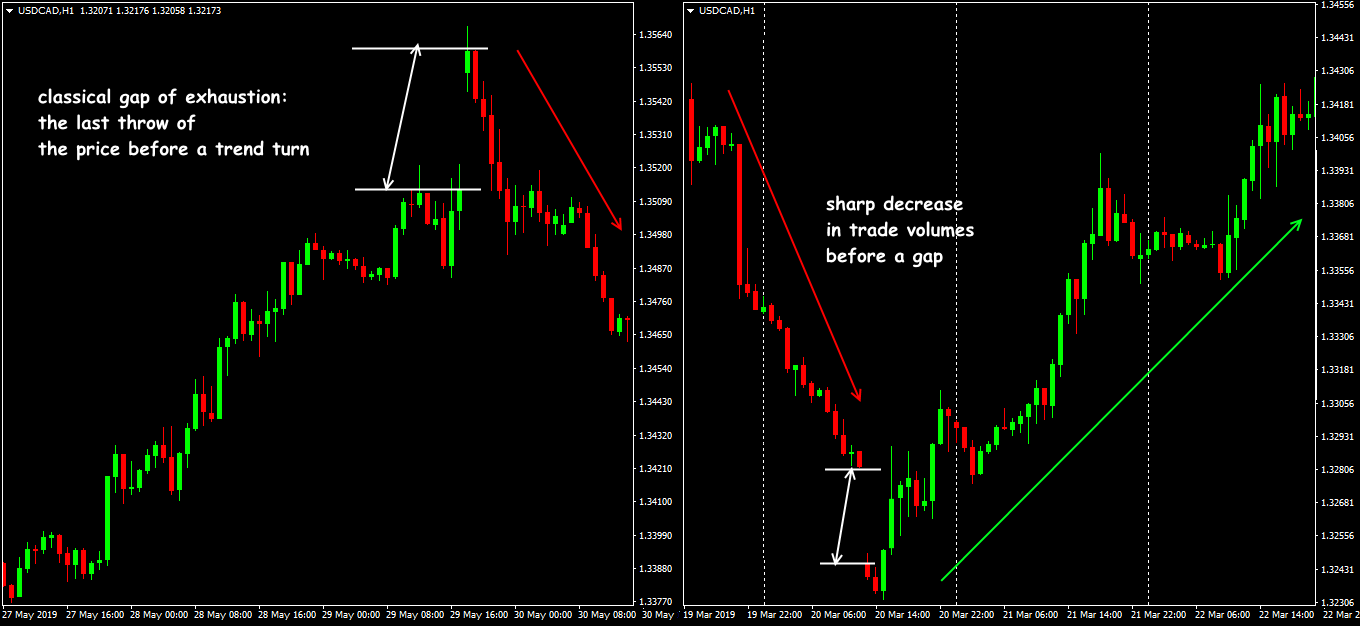

A gap exhaustion

It is formed at the end of the trend and is characterized by a sharp increase in volumes; usually occurs at the opening of the trading day. Small participants are waiting for the trend to continue, ignoring the signals (most often fundamental!) about its depletion.

At short periods, such a gap quickly closes. Open positions should be fixed, at least partially.

Gap Trading Strategies

You can read about entry points in the gap situation in Eric Nyman’s “The Small Encyclopedia of the Trader” and “Master-Trading: Secret Materials”. He suggests everyone to consider price gaps as patterns continuation of the trend, and the opening point of the transaction should coincide with the beginning of the gap.

The classical reasoning in the modern speculative market looks quite controversial. The most relevant tactics are:

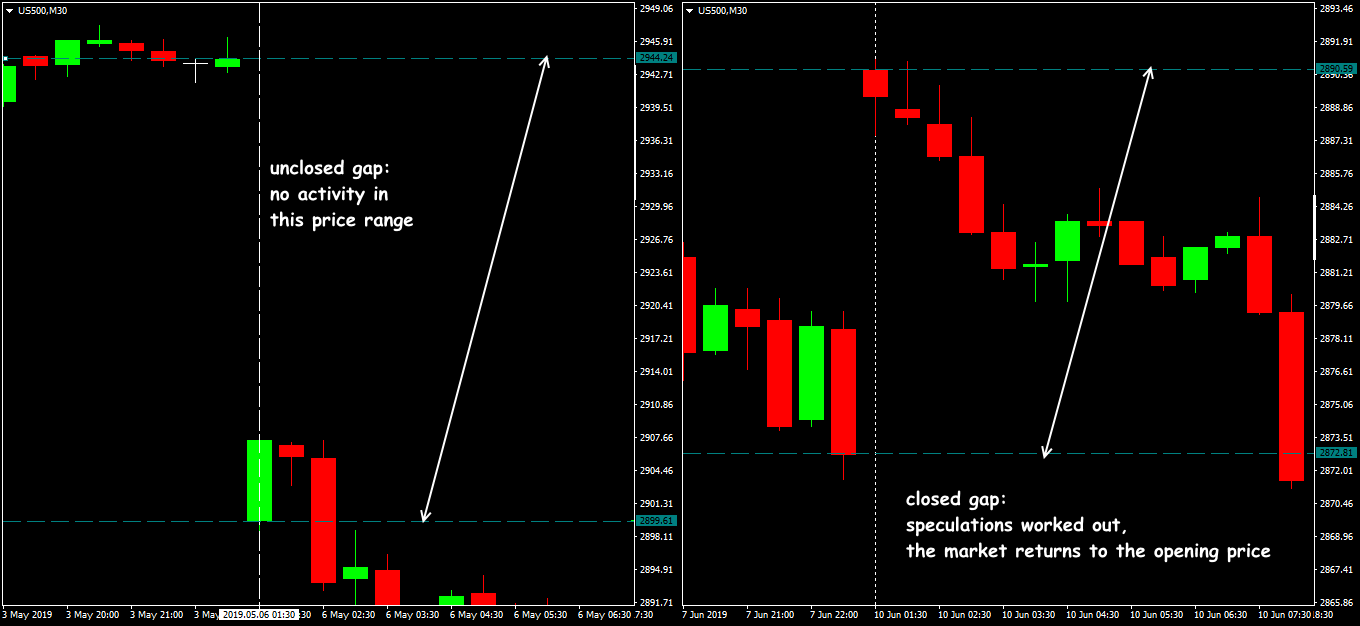

Closing the gap

According to statistics, most of all Forex price gaps quickly reverse rollback (“close”).

Trading on a rollback is considered stable at the opening of the week, but the closure of a strong gap, due to fundamental factors, can occur for several days or even weeks.

In 70% of cases, this happens during the trading day, maximum – the two. If the gap for such a period does not close, then the reason is more serious, and we must act differently.

At the beginning of the week, you can enter the market 30 minutes after the market opens, in the direction of the gap closing; the minimum goal is Friday’s closing level, Stop Loss is approximately 0.5 Take Profit. After the gap closes, the market can choose any direction.

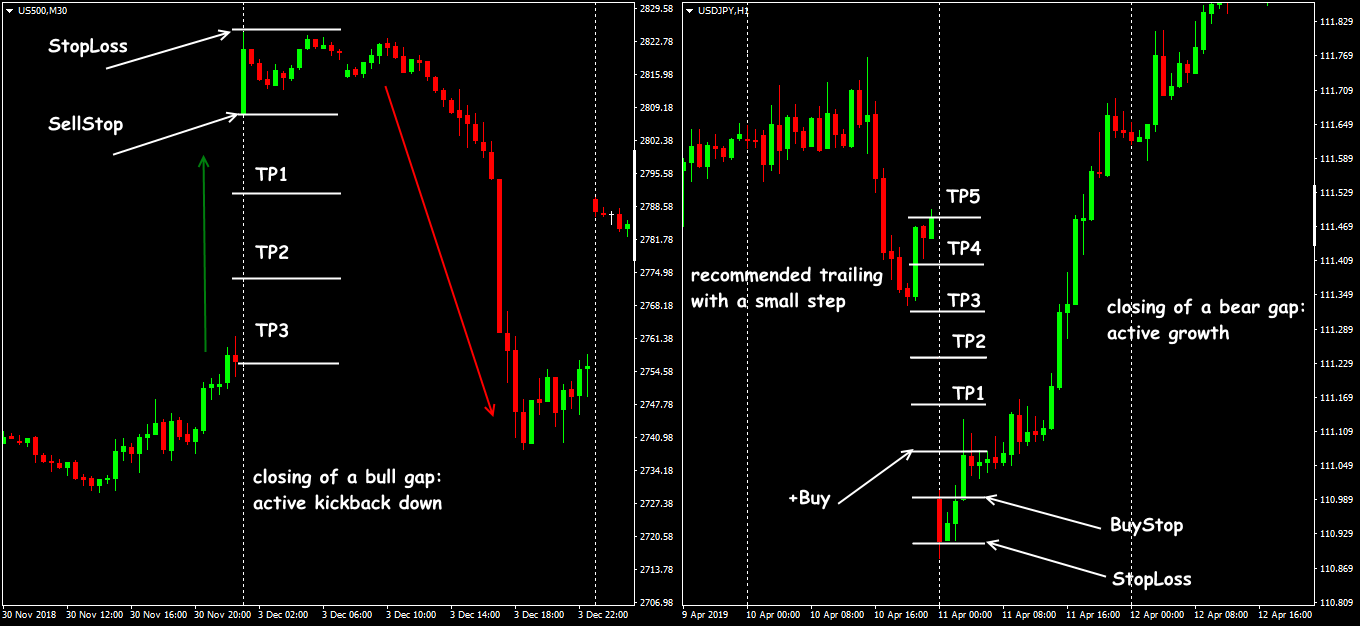

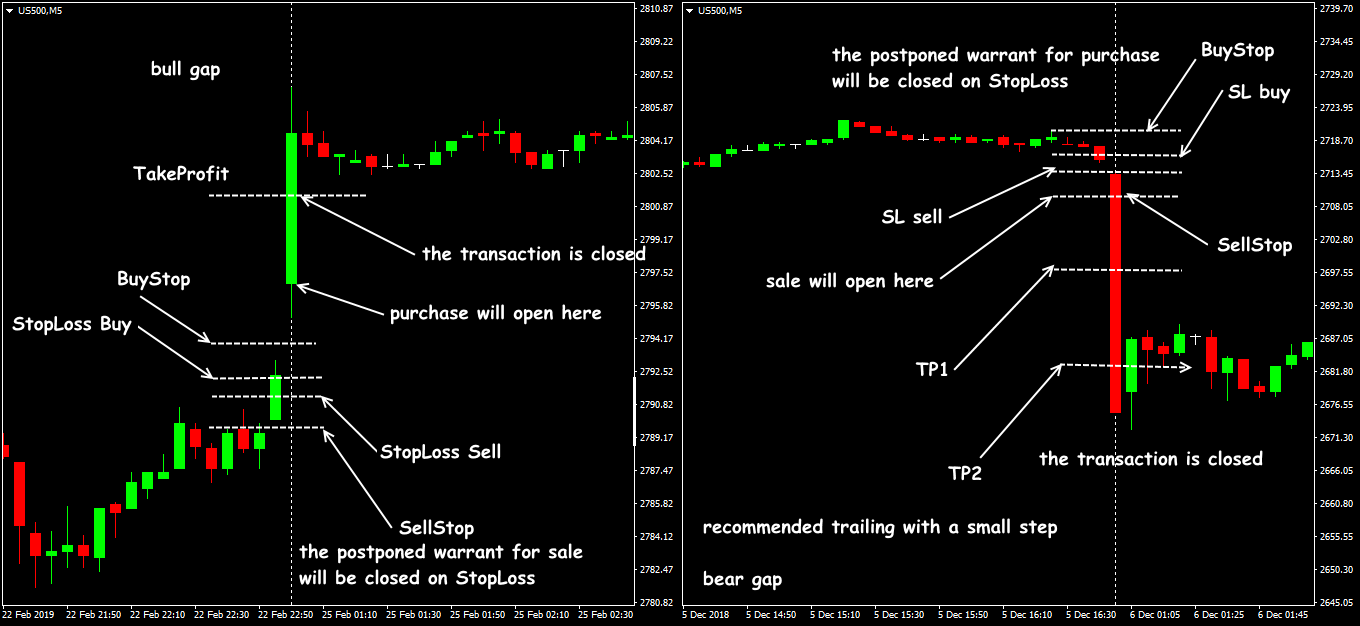

- Pending orders until the gap occurrence

The idea to put a bunch of BuyStop/SellStop in order to catch a possible price roll, or BuyLimit/SellStop in anticipation of a quick rollback, arises of almost every beginner. But it is very difficult to calculate where the throw will be unless you are a market maker and create this gap by yourself.

A gap is formed with the first quote of the new week. It means that the pending orders will have to be put on Friday as close to the market closure as possible, if, of course, your broker allows it.

The distance between orders should be small, but taking into account the fact that there is a high risk of broker processing (removing) these orders before the market closes.

As you understand, Stop Loss/Take Profit are required in such orders. It is recommended to control the moment of the market opening manually.

At the opening of the week, it all depends on how the broker works out your pending orders.

- If the opening price falls within the range between orders and they are present in the market (the broker has not canceled them) but are inactive for now – we just wait and continue to act according to the situation using traditional methods.

- Gap up above the BuyStop level: SellStop is automatically closed with Stop Loss, Buy is triggered (if the broker opened such an order!), and if it does not reach Take Profit, you will have to make a decision to close the purchase manually with a minimum profit, or at least enable trailing.

- Gap down below SellStop: we reason similarly, only for sale.

It should be noted that if a pending order falls into the gap zone, it will be executed at the first quote, not at a price set in the parameters.

More complex non-standard situations are possible, but they require a separate study.

A few practical notes

The gap is a strong support/resistance and strengthens the signals of many candlestick analysis patterns, such as the Morning Star. Each gap situation requires the special attention of the trader.

IMHO. Personally, we do not consider price gaps in the foreign exchange market (it does not matter – futures or spot assets) a robust technical figure. In the gap on commodity, index, commodity futures – we believe, but! The nature of the gap appearance on Forex is obscure due to the opacity of the pricing process.

In currencies, in 70% of cases, this is simply a “split” in the quote stream, which does not have any fundamental or psychological reason, that is, before trading a gap, you should always check on different sources of quotes.

Unscrupulous brokers often “draw” fake gaps, and as a rule, there are no similar gaps on other brokers. We invite the reader to check such situations and form their own opinion.

Try It Yourself

As you can see, backtesting is quite simple activity in case if you have the right backtesting tools.

To check this (or any other) analysis performance you can download Forex Tester for free.

In addition, you will receive 23 years of free historical data (easily downloadable straight from the software).

Sign Up to FTO Waitlist

Sign Up to FTO Waitlist