Intuition in trading: psychotechnics, miracle or self-deception?

What is intuition psychologists know the best: they believe that this is a special type of thinking involving the subconscious, the mechanism of which is actively explored, but still it is a terra incognita. Nevertheless, as a result of processing information, a person always receives from the subconscious a certain signal to action.

The modern financial market is not in vain considered a polygon for mass manipulation with the human consciousness − the corresponding section of science is called the crowd psychology.

Intuition in trading is effective weapon of the large market players, such a thing of the professional high art.

Especially erroneous in assessing the mechanism of intuition by newcomers, for them it seems like to try a luck at the roulette. The reality is much more complicated: intuitive trading involves a full analysis of many factors− both subjective and objective.

Let’s get to the point.

For whom this article?

Recommended:

- beginners with any level of experience and any size of deposit − to stop experiments and start working;

- to traders with a still unstable profit − to find and solve psychological problems faster;

- to all who constantly develops and aspires to use their intellect as much as possible.

The concept and mechanism of intuition

It is supposed that the left hemisphere of a human brain just and is responsible for intelligence − makes the detailed analysis of a situation and logical constructions, and the right hemisphere of a brain copes an intuition – forms a global picture and, finally, is responsible for result.

It is the mechanism of intuition that constantly searches for optimal options, generates new ideas and helps the trader to make decisions in situations where the price situation cannot be explained by standard technical or fundamental analysis.

In the financial market, intuition is based on the recognition of price patterns − approximately the way a grandmaster operates in a set of game combinations in chess. It is enough for a professional to show his chess position for a few seconds, so that he can remember and then can accurately recreate (or analyze) it if necessary.

However, the human brain remembers well only meaningful schemes, with the correct interrelationships of figures, and their random arrangement does not lend itself to structuring. And if you show the chess player (or trader) a position with a chaotic arrangement of figures, then the benefit of such a memorization is zero.

Intuition in trading: what’s the bottom line?

The main part of the brain-processed information is stored at a subconscious level, so the case of enlightenment seem to man a miracle, rather than the result of the usual analysis of data. Intuition is based on experience and common sense, helps to see the small details of the situation, and in the end − to save forces and time.

Analysis of the market prices requires to process a huge amount of the information: news, analytics, statistics, comments, indicator values. In the course of observing the market, the trader sees and analyzes key moments, while the subconscious mind remembers market conditions, trading methods and results.

Have the courage to follow your hear and intuition. They somehow already know what you truly want to be. Everything else is secondary.

Later, when similar situations occur, the subconscious will prompt the trader the scheme of actions, causing a sensation called sense on the trader’s slang. (see Intuition v Instinct Why Traders Need to Understand the Difference).

Discussions on the importance of intuition in trading are almost stopped today. Professionals believe that it is simply necessary to use intuition at moments of the special risk, for example, if there are many options (or a large amount of information) with a lack of time.

If the trader does not trust his intuition, then he misses the profit, which, at least, causes uncertainty.

Market Maker: Predator Intuition

We suggest to think about your role in the market − just evaluate yourself realistically, without ambition.

In terms of the market, players with deposits of less than $500000 can be a potential food for a market maker. The market role of the small trader is to enable large players to position their trades most favourably for their own purposes.

Market maker any way − false icebergs of volumes, false breakdowns, incorrect information − causes small speculators to give money that leave your pocket as a result of impulsive and incorrect trading actions (see Andre Minassian − Intuitive Trading).

Train your intuition, try to think like a market maker, filter all the false signals − trading, information, psychological. Analyze and remember the situations when you need to go against the market crowd, and when you can swim together with it, because big businesses are not interested in you at the moment.

We remind: Whales always swim against the current that plankton carries. Learn to swim next to the whales. Trust the intuition of large players and gradually become a predator, not a food.

The intuition of a successful beginner

Any newcomer (even on a small deposit) is trying to check how much this magical feeling is given to him personally. The brain does not know how and what to analyze, there is a minute scalping, deals are opened at each price movement, stress disables any knowledge − quick loss and panic.

There is no intuition in this scheme, even profitable orders are quickly closed, since the trader cannot calculate the further movement (see Five ways to awaken intuition in trading).

Many people come to the financial market, who have already earned capital in some other field of activity, and therefore believe that a high level of intelligence and life experience increase their chances of success in exchange trades.

Nothing like this happens − even considering the fact that such newcomers responsibly has finished primary learning.

What’s the catch?

The problem is that they are trying to argue with the market from the height of their ambitions. Remember: the market is always right, but it almost always gives the trader a chance (and sometimes − not one!) to make the right decision. Listen to your natural fears and logic − this is your young intuition in trading gives the first signals.

Professional: intuition as an attack weapon

In the process of making a trading decision, intuition in the professional trading takes into account all the factors, objective and subjective, calculated and graphic, price history and news background. But every intuitive decision should be carefully prepared and justified − noone trades on one sense only.

Look at it this way:

an experienced player pays attention to intuition signals, unless they contradict his trading strategy and the method of money management. The trade decision is still taken on the basis of the established criteria, even if it looks spontaneous.

The professional already knows that only one natural ability for intuition is not enough: it can (and must!) be constantly developed.

We are looking for hidden reserves!

In order to make intuition in trading effective, you need to practice working on different strategies − even unsuccessful − your subconscious mind should remember as many typical situations as possible. This experience will work as the information filter when looking at the price chart. It is recommended to fix thoughts in detail and to form private keys and conclusions.

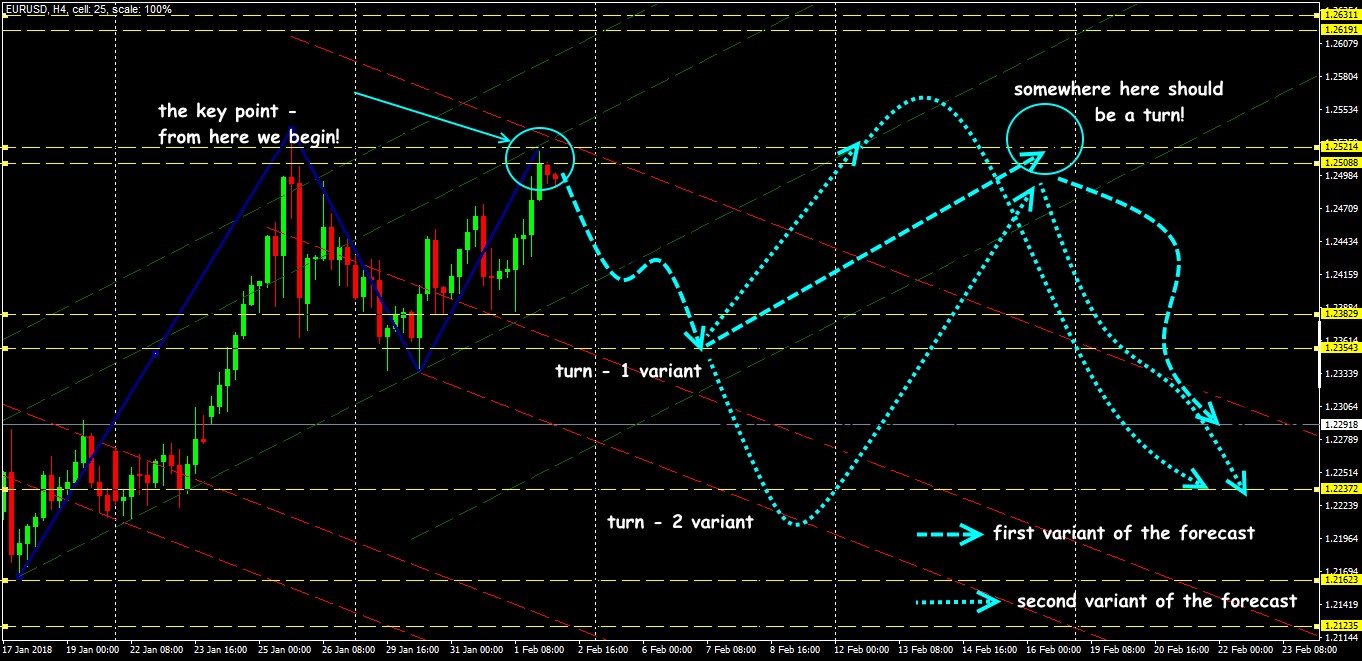

From personal experience: the development of intuition by practice, this is of course a main method, but for training there is a simpler way − just take a real price chart and close its right half with a regular sheet of paper.

Expert advice: build trend lines and key levels yourself!

We look at the left side of the chart: we are looking for signals, patterns, we fix the price levels, the phase of market (trend, flat, correction). Next on paper, draw your forecast and actions in each situation with all parameters (input, output, Stop Loss/Take Profit, volume).

No foundation and minimum of the calculations − we all try to determine visually. Then we open the real data and analyze the situation when the intuition gave a lossy signal (also here Intuitive Traders).

Expert advice: we look at the real chart – the forecast is practically fulfilled!

Further, we complicate the conditions, but we necessarily check the result of the intuitive transaction for compliance with the personal trading system. We try to spend as little time as possible on this process, optimally − no more than 1-2 minutes.

If you manage to make a successful forecast at least 50% of the blind tests, then you have made the intuition to get involved in the trading process. If the result is not that high − intuitive trading is not yet for you.

We remind: intuition can be effective only on trading assets, which you know well and can profit from them by usual technical trade.

But here’s the problem: sometimes you should not trust your intuition!

Meanwhile, for those who plan to trade exclusively on the trading sense, we remind:

- the intuition will never be able explain clearly why such a conclusion was made or a specific transaction was opened;

- the intuitive decision is influenced by mental factors (people, events, health, fear, greed) − you need to learn how to disconnect them;

- if intuition is silent − do not try to replace it with fantasies, do not draw at the market what is not there− or trade strictly according to technology, or stay out of the market.

- the speculative or thin market causes an illusion of understanding, that is where we do not rely on intuition.

Those who are ready to work on themselves recommend Malcolm Gladwell’s book The Power of Thinking Without Thinking (you can buy here), in which he analyzes the situations of distrust of intuition.

And what is the result?

The more experience a trader has, the higher his chances of developing intuition.

In the market there are no hard factors and rules for predicting the price movement, and one who knows how to feel the market subjectively, always has an advantage.

If this sense is backed by real experience and strong knowledge, extensive erudition and strong character − only then this whole mix will be a model of the ideal trader, able to earn in any situation.

Try It Yourself

Trading psychology is one of the essential pillars of the Forex success, so even if you are an experienced trader, you shouldn’t dismiss a trading psychology advice.

Do you need a comfortable space in order to take control over your emotions and get prepared to the live trading?

Simply download Forex Tester for free. In addition, you will receive 23 years of free historical data (easily downloadable straight from the software).

Grow your patience, boost your trading skills, learn to avoid psychological traps without drawing your live account.

Share your personal experience of using intuition in trading. Was this article useful for you? It is important for us to know your opinion – share your comments below!

Sign Up to FTO Waitlist

Sign Up to FTO Waitlist