Bollinger Bands + RSI + Stochastic scalping strategy: how the small step can bring big achievements

We have tried out different indicators and their combinations, but mostly within the 1H timeframes or 30 M. Could we forget about scalpers?

Definitely not

Besides, we have seen all these three indicators in action and we can understand the origins of the traders’ preferences towards them.

Do they perform the same smoothly while scalping?

Keep reading and learn the results.

A Couple of Words About Indicators

Bollinger Bands is a great tool to examine the volatility of the currency pairs. This indicator consists of 3 bands, which form the oversold, overbought levels and a middle band as a base. In short, it can be read as following: when the price reaches the upper band, we should be ready to sell and on the contrary when the price touches the lower band, we should be ready to buy.

Remember we have talked how differently you can read the Bollinger Bands indicator and how it can be itself a quite complicated system. If you haven’t read, please check it here.

While trading this strategy, we perceive the price piercing the Upper/Lower Bands as a sign of the future trend reversal. However, we totally lose sight of the price behavior between the bands and therefore we can lose some perspective entry points. Again – it is still a matter of the further adjustment and backtesting.

We use additionally RSI, and Stochastic Oscillator to find the enter moments.

RSI shows the strength of the trend and the possibility of the trend reversals as well as overbought and oversold periods.

Stochastic Oscillator consists of two averages ‘locked’ between 0 and 100 levels, providing signals while reaching the Overbought (over 80 line) and Oversold (below 20 line) levels. *

Let’s check the scalping strategy based on the combo of the 3 great indicators that proved to be resultative: Bollinger Bands, RSI and Stochastic.

* In the section called “Further Adjustments” you can find our advice how can the setting of the strategy modified further. Feel free to try different modifications and compare the results. Check this part in order to try all the settings and the way they can influence the outcome of the strategy.

Technical Information

Currency pair: major currency pairs.

Indicators: Bollinger Bands (20, 2. SMA) and RSI (14), Stochastic Oscillator (5, 3, 3).

Time Frame: 5 min.

When do you start the long order (buy)?

- The price goes below the Lower Bollinger Band

- RSI reaches below 30 level

- Stochastic Oscillator reaches below 20 level

- Enter the buy trade at the close of the candle where all these 3 conditions meet

- Exit the trade when the first candlestick closes above the Middle band.

- Stop Loss: 10 pips below the lowest value of the piercing candlestick

- Take profit: 20 pips.

When do you start the short order (sell)?

- The price goes above the upper Bollinger Band

- RSI reaches above the 70 level

- Stochastic Oscillator reaches above 80 level

- Open a Sell trade at the close of the candle where all these 3 conditions meet

- Exit the trade when the first candlestick closes beneath the Middle band

- Stop Loss: 10 pips above the highest value of the piercing candlestick.

- Take profit: 20 pips.

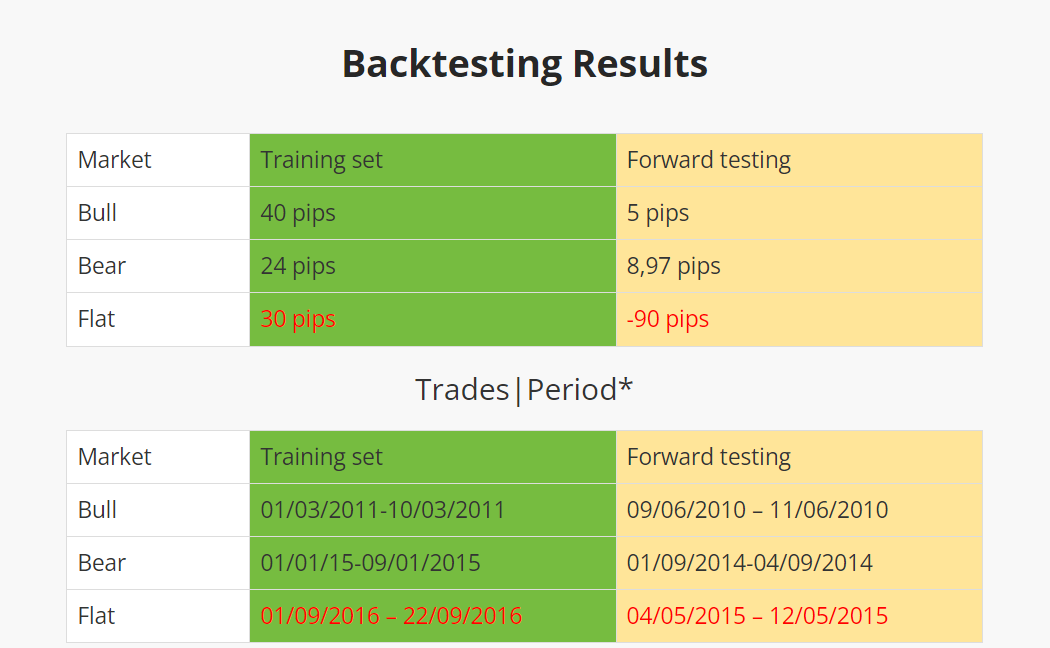

*How long it took us to enter the 50 trades for the Training Set and 20 trades for the Forward Testing.

Reminder:

In order to save your valuable time and efforts, we have introduced the system of backtesting when you perform only 50 trades through 3 different types of market (Bullish, Bearish and Flat markets) and then again 20 trades through the given types of market, but during other periods. Then with simple math calculations, we can make conclusions about effectiveness or irrelevance of the chosen strategy.

The full version of the theory of our backtesting experiments and how did we came up with the idea of such backtesting you can read here.

Conclusions

As you can see the strategy showed positive and sustainable results within all the markets.

However, the size of the profits is quite moderate, we should bear in mind that it is scalping strategy and besides with the recommendations in the “Further Adjustment” section you can also backtest different variations of the strategy and aim for bigger profits.

And the last important thing:

it would be great if you perceived our backtesting experiment as the sign that you shouldn’t believe blindly anything found on the Internet especially if you bet your real money on it. Try any information, test it, prove it and then use it within the real-time trading.

Further Adjustments for Better Results

What else you can try to adjust:

- Indicators settings – we use the default settings, however, there are still a lot of options and moreover – there are a lot of strategies based on the custom indicators’ settings;

- Reading of the indicators – as we have mentioned above, there are different ways to trade Bollinger Bands, for example, don’t lock yourself into one of them, try different readings;

- Timeframe – you can always test this strategy during the longer timeframes and day trading even;

- Stop Loss and Take Profit – we have set the stable number of both, but what if manual adjustment of the SL and TP can bring you better results?

- Change the combination of the indicators.

Try It Yourself

As you can see, backtesting is quite simple activity in case if you have the right backtesting tools.

The testing of this strategy was arranged in Forex Tester with the historical data that comes along with the program.

To check this (or any other) strategy’s performance you can download Forex Tester for free. In addition, you will receive 23 years of free historical data (easily downloadable straight from the software).